Bank guarantee

Bank guarantee Private Individual

Together to facilitate your access to real estate

With SOLIDIS' real estate guarantee, a simple, streamlined guarantee solution that does not require any additional fees, access to housing or land ownership will no longer be a mere hypothetical dream for you. Through its support in the realization of their housing projects, SOLIDIS acts in favor of improving the quality of life of Malagasy households, especially middle managers.

SIMPLICITY: The setting up and the instruction of your file are done directly with your manager...

SIMPLICITY: The setting up and the instruction of your file are done directly with your manager...

FLEXIBILITY: The procedures are simplified and the SOLIDIS commission is a flat rate for the entire duration of the loan...

FLEXIBILITY: The procedures are simplified and the SOLIDIS commission is a flat rate for the entire duration of the loan...

SPEED: Due to simplified formalities, the guarantee can be obtained quickly and allows shortening the loan release time.

SPEED: Due to simplified formalities, the guarantee can be obtained quickly and allows shortening the loan release time.

SAFETY: In addition to setting up your file, SOLIDIS is committed to your side by providing a reliable financial guarantee.

SAFETY: In addition to setting up your file, SOLIDIS is committed to your side by providing a reliable financial guarantee.

INDIVIDUAL who has a bank account and whose income is regularly deposited in this account.

We invite you to contact your banker directly, who can suggest you a loan guaranteed by SOLIDIS.

project type: purchase, renovation or construction

project type: purchase, renovation or construction

Guarantee rate: 100% of the loan amount

Guarantee rate: 100% of the loan amount

Guaranteed amount: up to MGA 500 million

Guaranteed amount: up to MGA 500 million

Guarantee commission: 4% excluding VAT of the loan amount

Guarantee commission: 4% excluding VAT of the loan amount

Repayment term: up to 12 years (depending on the term of the loan)

Repayment term: up to 12 years (depending on the term of the loan)

Processing time by SOLIDIS : 3 to 5 days

Processing time by SOLIDIS : 3 to 5 days

Partner

Company

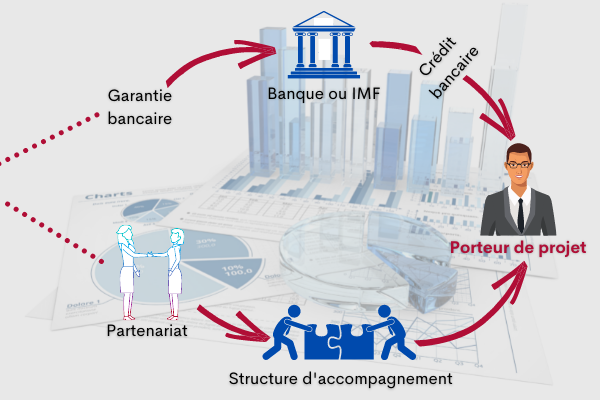

« Are you planning to make major investments to start up or expand your business? Or do you want to generate more cash to support your operations? Or would you like to have a guarantee for a contract or a tender? And, are you having difficulty obtaining a bank loan or a guarantee? » Individual Signing Guarantee - ISG Direct Guarantee - DC Technical & Accounting Assistance Do you require bank access to loans for increasing your working capital or for financing your investments? The SOLIDIS FINANCIAL GUARANTEE is the safe and reliable solution for easy access to bank loans. Presented in the additional form of a guarantee in favor of lending institutions, it also includes upstream and downstream technical support. Formal or non-formal SME, SMI but who are ready to formalize their activity in parallel with the examination of the case at our level. Direct Guarantee - DC Technical & Accounting Assistance With the CAUTION DIRECTE of SOLIDIS, , you get individual and direct support in terms of financial commitment in order to secure your business transactions and facilitate your access to public/private markets with conditions different from those of banks. Individual Signing Guarantee - ISG Technical & Accounting Assistance Our strategic and operational experience allows you to anticipate throughout the life of your business. With specialized services in management, accounting and taxation, the federation supports you in order to promote your access to credit and further expand business. Individual Signing Guarantee - ISG Direct Guarantee - DC

Whatever your field of activity, opt for SOLIDIS'guarantee and financing solutions to allow you to have access to operations and projects quickly..And to support the strengthening of the administrative and financial management of your business. ,faites appel à l'assistance technique de nos experts.

Individual Signing Guarantee - ISG

PROFITABILITY: With the SOLIDIS guarantee, keep safe your financial capacity.

PROFITABILITY: With the SOLIDIS guarantee, keep safe your financial capacity.  RELIABILITY: With the SOLIDIS’ support, your loan application is more credible with the bank or financial institutions.

RELIABILITY: With the SOLIDIS’ support, your loan application is more credible with the bank or financial institutions.  GUARANTEE/LEVERAGE: SOLIDIS provides assistances at all the steps to follow. It advises you on the banking analysis of your finance application file.

GUARANTEE/LEVERAGE: SOLIDIS provides assistances at all the steps to follow. It advises you on the banking analysis of your finance application file.  SPEED: Thanks to simplified formalities, the guarantee enables to quicken the disbursment of your loan.

SPEED: Thanks to simplified formalities, the guarantee enables to quicken the disbursment of your loan.

To see also...

Direct Guarantee - DC

Do you want to secure your transactions?

Do you want to secure your transactions?  Do you want to establish a climate of trust with your partners?

Do you want to establish a climate of trust with your partners?  Do you want to generate more cash to support your operation?

Do you want to generate more cash to support your operation?  Do you want to have available collateral for a contract or a public call for tender?

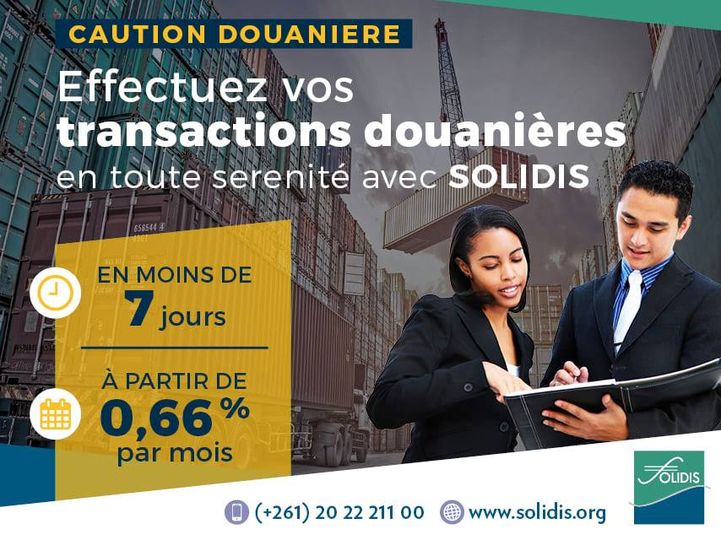

Do you want to have available collateral for a contract or a public call for tender?  SPEED: you will be notified of our answer within 7 days of your request

SPEED: you will be notified of our answer within 7 days of your request  COMPETITIVITY: no bank intervention

COMPETITIVITY: no bank intervention  SAFETY: it's a guarantee of security for your partners on the good execution of a contract or the good achievement of a service

SAFETY: it's a guarantee of security for your partners on the good execution of a contract or the good achievement of a service  ECONOMIC: our caution gives you a better cash flow management

ECONOMIC: our caution gives you a better cash flow management  TAILOR-MADE: our surety is adapted to your needs from the simplest to the most complex.

TAILOR-MADE: our surety is adapted to your needs from the simplest to the most complex.  SME, SMI duly formalized

SME, SMI duly formalized

SME, SMI has existed for at least 6 months

SME, SMI has existed for at least 6 months

Guarantee amount: 100% of the amount of your commitment

Guarantee amount: 100% of the amount of your commitment  Amount of commitment: up to MGA 500 million

Amount of commitment: up to MGA 500 million  Payment period for your customers / suppliers: up to 60 days

Payment period for your customers / suppliers: up to 60 days  Duration of treatment by SOLIDIS: 7 working days maximum

Duration of treatment by SOLIDIS: 7 working days maximum

Our surety

Partner

To see also...

Technical & Accounting Assistance

Help you see your business from a different perspective.

Help you see your business from a different perspective.  ..Support you when you tackle new challenges ...

..Support you when you tackle new challenges ...  Provide you with personalized assistance in setting up a business plan.

Provide you with personalized assistance in setting up a business plan.  you keep the accounts and follow up on deadlines.

you keep the accounts and follow up on deadlines.  SME Formal

SME Formal  Beneficiary of the guarantee SOLIDIS

Beneficiary of the guarantee SOLIDIS  Member of MIARY Federation

Member of MIARY Federation  Tenue de comptabilité by competent professionals to have figures characterizing the economic and financial situation of your company: recording of operations, elaboration of accounting follow-up documents, establishment of financial statements, tax and social returns.

Tenue de comptabilité by competent professionals to have figures characterizing the economic and financial situation of your company: recording of operations, elaboration of accounting follow-up documents, establishment of financial statements, tax and social returns.  Personalized support for the development of your business plan: determination of activity hypotheses, definition of resources (technical and human) corresponding to each scenario, development of forecasted accounts in accordance with the accounting plan in force, analysis of each scenario (advantages, disadvantages, threats, opportunities), establishment of the business plan (legal, institutional, organizational, technical, financial and commercial), follow-up of deadlines.

Personalized support for the development of your business plan: determination of activity hypotheses, definition of resources (technical and human) corresponding to each scenario, development of forecasted accounts in accordance with the accounting plan in force, analysis of each scenario (advantages, disadvantages, threats, opportunities), establishment of the business plan (legal, institutional, organizational, technical, financial and commercial), follow-up of deadlines.  Support in finding financial partners

Support in finding financial partners

To see also...

Institutions

Your needs are our focus. Through our integrated model, our experience, and by sharing the risk on your SME loans, we are committed to being your trusted partner in growing your portfolio with reliable guarantees at all levels

As a partner, we make your needs our top priority. On the one hand, we ensure the credibility of the projects presented to you through our contribution of expertise in selection, evaluation and follow-up. On the other hand, we actively seek out different investment opportunities in various growth sectors that offer the greatest potential for growth.

Garantie Partielle de Portefeuille - GPP (Partial Portfolio Guarantee)

Garantie Par Lot - GPL (Batch Guarantee)

Garantie Partielle de Portefeuille - GPP (Partial Portfolio Guarantee)

This new guarantee scheme is intended for partner lending institutions with recognized expertise in credit analysis. It is characterized by a delegation of guarantee in favor of SMEs granted to these lending institutions for the development of their SME portfolio in meso finance

INSURANCE: As a financial instrument, SOLIDIS guarantees the repayment of the loans granted to the SMEs by providing financial guarantees.

INSURANCE: As a financial instrument, SOLIDIS guarantees the repayment of the loans granted to the SMEs by providing financial guarantees.

RISK-SHARING : on loans requested by companies in order to jump the financing lock and contribute to the development of the business fabric.

RISK-SHARING : on loans requested by companies in order to jump the financing lock and contribute to the development of the business fabric.

CREDIBILITY: rubrique à supprimer car SOLIDIS ne participe pas à la sélection ou à l'valuation des dossiers de la GPP

CREDIBILITY: rubrique à supprimer car SOLIDIS ne participe pas à la sélection ou à l'valuation des dossiers de la GPP

HORIZON: optimizing the relationship between financial institutions and companies by opening up to a new category of customers.

HORIZON: optimizing the relationship between financial institutions and companies by opening up to a new category of customers.

Micro, Small and Medium Enterprises (MSME)

To become a SOLIDIS PARTNER or for more details, please contact us at: information@solidis.org

FUNCTIONING: The terms and conditions of the partnership between SOLIDIS and the Partner Institutions are governed by the agreement signed between the two parties

FUNCTIONING: The terms and conditions of the partnership between SOLIDIS and the Partner Institutions are governed by the agreement signed between the two parties

BONDING EFFECT: SOLIDIS' surety is a liquid guarantee that can be more easily mobilized, compared to a more traditional collateral security, for partner institutions in the event of default by the counterparty concerned. Therefore, it will improve risk control while promoting the partner's commercial action.

BONDING EFFECT: SOLIDIS' surety is a liquid guarantee that can be more easily mobilized, compared to a more traditional collateral security, for partner institutions in the event of default by the counterparty concerned. Therefore, it will improve risk control while promoting the partner's commercial action.

Partner

To see also...

Garantie Par Lot - GPL (Batch Guarantee)

Garantie Par Lot - GPL (Batch Guarantee)

Ce nouveau dispositif de garantie est destiné aux établissements prêteurs partenaires disposant d’une expertise reconnue en matière d’analyse du crédit par une délégation d’octroi de garantie en faveur de PME, via un scoring, pour le développement de leur activité de méso finance et de leur portefeuille.

INSURANCE: As a financial instrument, SOLIDIS guarantees the repayment of the loans granted to the SMEs by providing financial guarantees.

INSURANCE: As a financial instrument, SOLIDIS guarantees the repayment of the loans granted to the SMEs by providing financial guarantees.

RISK-SHARING on loans requested by companies in order to jump the financing lock and contribute to the development of the business fabric.

RISK-SHARING on loans requested by companies in order to jump the financing lock and contribute to the development of the business fabric.

CREDIBILITY: To evaluate a request for financing, the credit file must be well structured. SOLIDIS contributes significantly to the expertise of the files in terms of selection, evaluation and support during the preparation of the financing file.

CREDIBILITY: To evaluate a request for financing, the credit file must be well structured. SOLIDIS contributes significantly to the expertise of the files in terms of selection, evaluation and support during the preparation of the financing file.

HORIZON: optimizing the relationship between financial institutions and companies by opening up to a new category of customers.

HORIZON: optimizing the relationship between financial institutions and companies by opening up to a new category of customers.

Micro, Small and Medium Enterprises (MSME)

To become a partner of SOLIDIS or for more details, please contact us at : information@solidis.org

FUNCTIONING: The terms and conditions of the partnership between SOLIDIS and the Partner Institutions are governed by the agreement signed between the two parties

FUNCTIONING: The terms and conditions of the partnership between SOLIDIS and the Partner Institutions are governed by the agreement signed between the two parties

BONDING EFFECT: SOLIDIS' surety is a liquid guarantee that can be more easily mobilized, compared to a more traditional collateral security, for partner institutions in the event of default by the counterparty concerned. Therefore, it will improve risk control while promoting the partner's commercial action.

BONDING EFFECT: SOLIDIS' surety is a liquid guarantee that can be more easily mobilized, compared to a more traditional collateral security, for partner institutions in the event of default by the counterparty concerned. Therefore, it will improve risk control while promoting the partner's commercial action.

To see also...

Garantie Partielle de Portefeuille - GPP (Partial Portfolio Guarantee)